Llc Tax Extension Deadline 2024

Llc Tax Extension Deadline 2024. Deadline for filing the 2023 tax return (form 1120) and paying any tax due if an extension is requested. Llc owners who are unable to meet the filing deadline can request an extension.

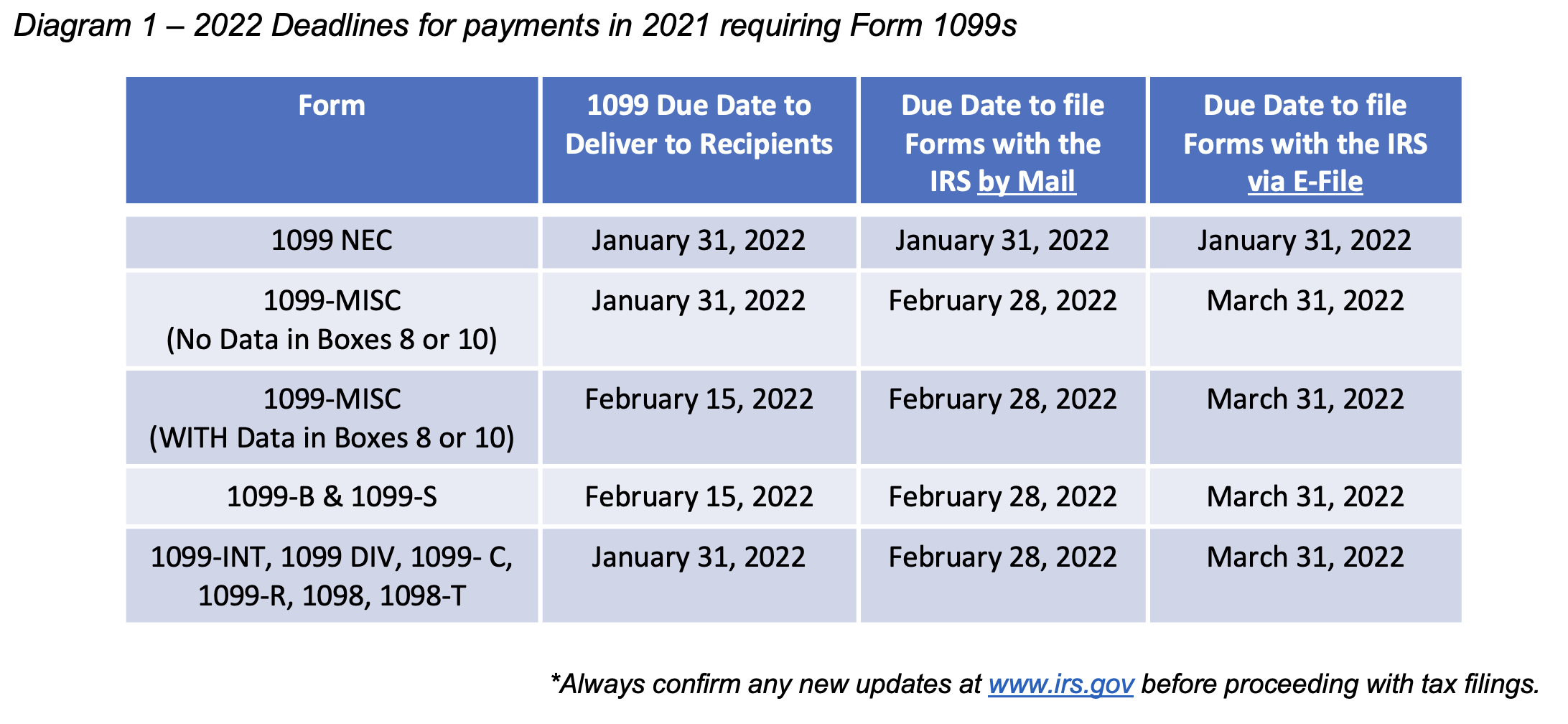

Deadline for filing the 2023 tax return (form 1120) and paying any tax due if an extension is requested. Businesses must issue form 1099 to qualifying recipients.

This Means You File Your Business Taxes At The Same Time You File Your Personal Income Taxes.

Navigating the world of taxes as a limited liability company.

Estimated Tax Payment Due For The Previous Year.

This guide will help you understand the critical llc tax deadlines for llcs in 2024, how to file your taxes, and what you need to know if you’re operating as a sole proprietorship.

Llc Tax Extension Deadline 2024 Images References :

Source: anjelamelody.pages.dev

Source: anjelamelody.pages.dev

Llc Tax Filing Deadline 2024 Irs Aretha Marnia, The process and deadlines for filing extensions may vary depending on the type of tax return and jurisdiction. For the 2023 tax year, filed in 2024, llcs filing as sole proprietors must submit form 1040 by april 15 without an extension.

Source: linetmerilyn.pages.dev

Source: linetmerilyn.pages.dev

Llc Tax Extension Deadline 2024 Devi Kaylee, If your llc is registered. Owners of llcs are allowed to file extensions if they are unable to get their taxes done in time.

Source: barbettewprue.pages.dev

Source: barbettewprue.pages.dev

Tax Filing Deadline 2024 For Llc Elsy Christin, This means you file your business taxes at the same time you file your personal income taxes. Llc owners who are unable to meet the filing deadline can request an extension.

Source: georgiawcarole.pages.dev

Source: georgiawcarole.pages.dev

Llc Business Tax Deadline 2024 Calendar Farra Beverly, Navigating the world of taxes as a limited liability company. If your llc is registered.

Source: daraqcarlita.pages.dev

Source: daraqcarlita.pages.dev

When Is The Tax Deadline 2024 Extension Helen Odelinda, The 2024 deadline to file individual income tax returns for 2023 is april 15, 2024. File business taxes after an extension, partnerships, llcs and s corporations using a calendar year:

Source: tobiqkarlie.pages.dev

Source: tobiqkarlie.pages.dev

Llc Tax Return Deadline 2024 New York Dana BetteAnn, Here are the main tax deadlines for 2023 for small business owners: If you pay quarterly taxes, the first quarter’s payment for 2024 is due on this day.

Source: linetmerilyn.pages.dev

Source: linetmerilyn.pages.dev

Llc Tax Extension Deadline 2024 Devi Kaylee, Refer to the irs tax calendar for general information. For example, if your s.

Source: found.com

Source: found.com

2024 Tax Deadlines for the SelfEmployed, With an extension, the deadline for filing is october 15. The extended tax deadline for those who file for an extension is either september 16, 2024 or october 15, 2024.

.png?format=1500w) Source: www.ascendllc.co

Source: www.ascendllc.co

2024 Tax Deadlines — Ascend Consulting, What are the deadlines for llc tax filing in 2024? Owners of llcs are allowed to file extensions if they are unable to get their taxes done in time.

Source: dodyqkimberlyn.pages.dev

Source: dodyqkimberlyn.pages.dev

Extended Tax Filing Deadline 2024 Terza Michal, The extended tax deadline for those who file for an extension is either september 16, 2024 or october 15, 2024. March 15, 2024 file business taxes after an extension, partnerships, llcs and s corporations using.

The Extended Tax Deadline For Those Who File For An Extension Is Either September 16, 2024 Or October 15, 2024.

Any taxes owed should still be paid by the original tax deadline.

The Extended Tax Deadline For Those Who File For An Extension Is Either September 16, 2024 Or October 15, 2024.

March 15, 2024 file business taxes after an extension, partnerships, llcs and s corporations using.

Posted in 2024